Digital Wallet for the Digital Era

A versatile digital wallet and payment solution that includes prepaid cards, virtual POS, softPOS and open banking. Ideal for businesses seeking e-money licenses or developing loyalty programs, and more.

Advantages

Up to 50% Time and Cost Saving

Modular and Flexible Infrastructure

Multi-Platform Support

iOS – Android Native

React Native

Flutter

Certified

Central Bank

Banks Card Association

24/7 Customer Support

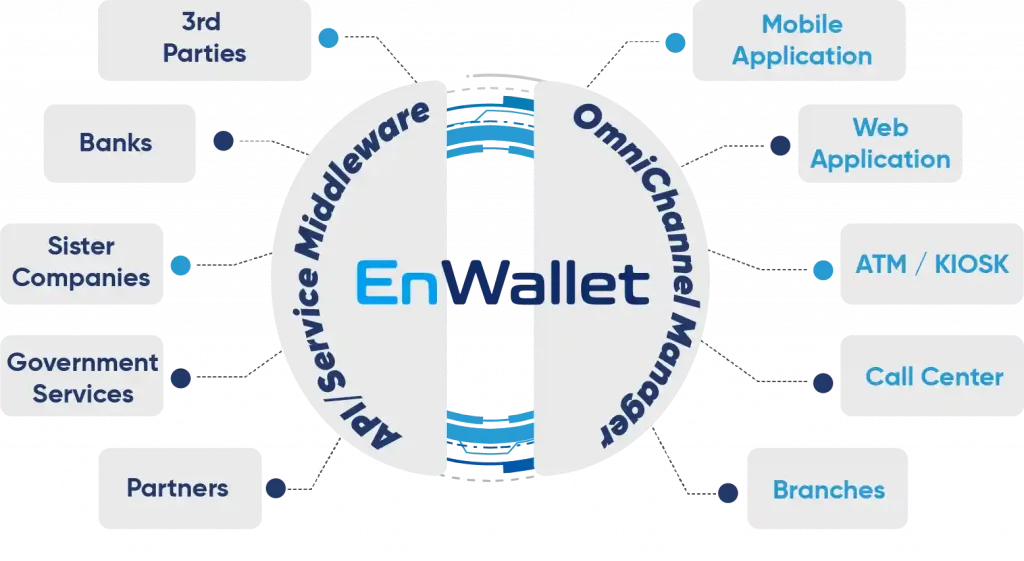

Advanced Omni-Channel Architecture

High Security Standards

Customizable &

White-Label Option

Core of Fintech

- Customer Opening

- Account Opening

- Account Update

- Account Close

- Transaction History

- Transaction History Sharing

- Invoice Monitoring

- Invoice Sharing

- Deposit Accounts

- Money Transfer to IBAN

- Money Transfer to Name

- Money Transfer to GSM

- Currency Exchange

- SWIFT

- Transfer through Broker

- Cashier Transactions

- Cash Management

- Registered Customer Transactions

- Open Banking Payment

- Listing

- Monitoring

- Add / Update / Delete

- Limit Calculations

- RM / Customer Limit Transactions

- RM / Customer Limit Calculations

- E-Wallet Account Opening

- Prepaid Card Application

- Prepaid Card Issuing

- Top-up

- QR Payment

- Wallet to Wallet Transfers

- Wallet to IBAN Transfers

- Wallet to Name Transfers

- Transaction History Monitoring

- Other Bank Accounts (Open Banking)

- Blockage Transactions

- Fee & Commission Management

- Currency Mark Ups

- Operation Center Management

- Document Management

- Reports

- Corporate Customer Management

- RM Management

- Branch Management

- HQ Management

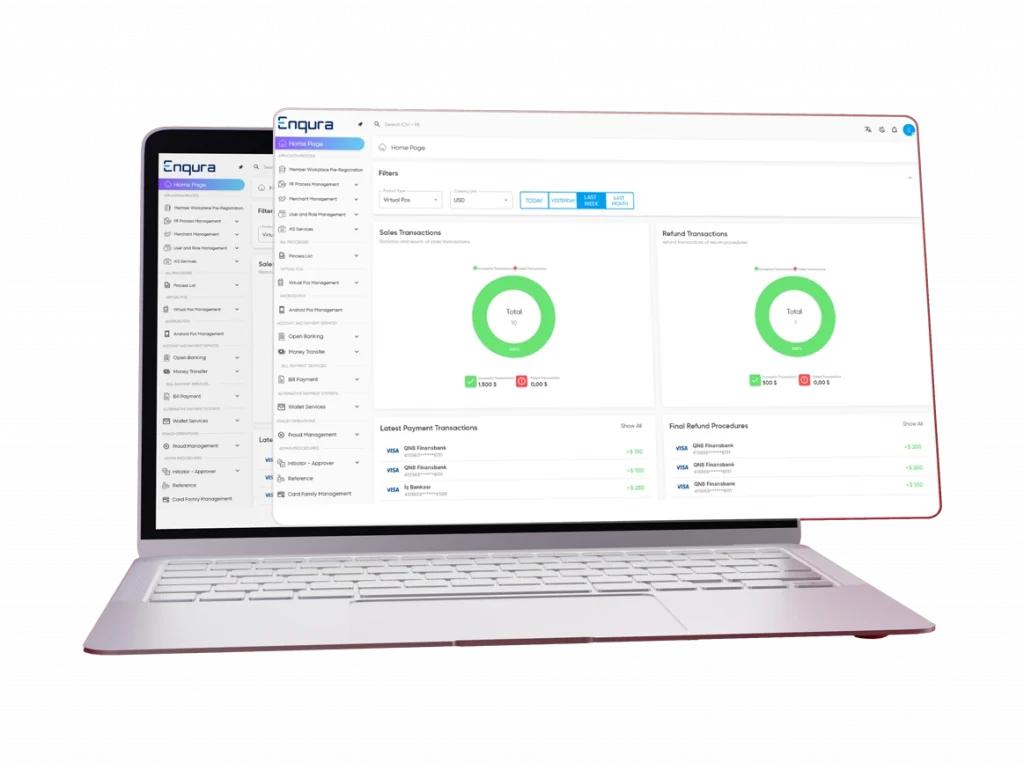

Core of Digital Payments

As the central component of an end-to-end payment system, it facilitates partner and third-party services in addition to offering a range of wallet functionalities. EnWallet supports and is compliant with Open Banking, BaaS (Banking as a Service) and Payments System Directives.

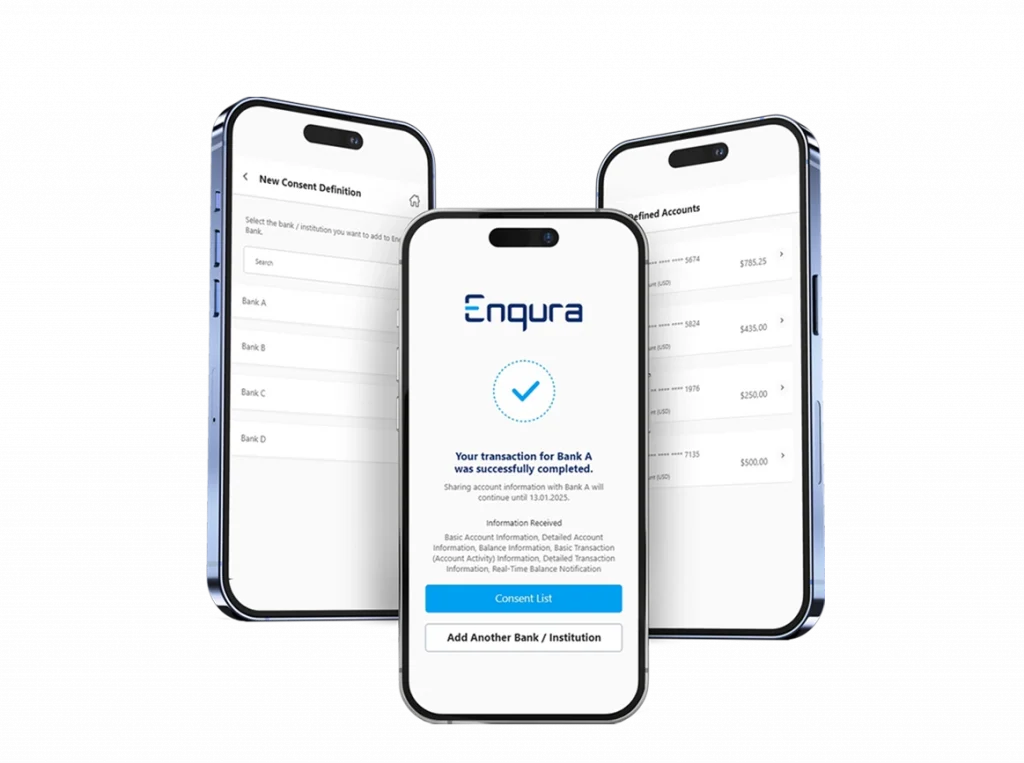

Open Banking Module

All necessary solutions for sharing (account servicing payment service provider) and consuming (third party payment service providers) Open APIs are provided in a single platform. (EnWallet Open Banking Platform is fully compliant with the latest BKM Gate specifications, holds the BKM certifications and is licenced by the Turkish Central Bank.)

Account Servicing Payment Service Provider (ASPSP): It provides financial institutions (banks or payment facilitators) access to authorised third parties to gather account information, and initiate payments through APIs based on the customer’s explicit consent.

Third-Party Payment Service Providers (TPP): They act as intermediaries between clients and their banks, facilitating secure funds transfer and access to account data.

Payment Gateway

Enqura Payment Gateway supports multiple payment methods, including credit cards, debit cards, digital wallets, open banking payments and more. It enhances the overall customer experience and contributes to higher conversion rates for businesses bringing revenue and profit maximisation.

EnWallet Tap2Mobile

EnWallet Tap2Mobile accepts contactless payments from Android phones, tablets and kiosks in a secure way. It does not only support multiple acquirers, but also ensures security and mobility for seamless transactions, delivering a cost-effective solution that significantly reduces fraud risks.

EnWallet provides more than 120 ready-to-use financial features that enable your company to implement various B2B and B2C business models.

Simplify your global finances with EnWallet’s Multi-Currency Account, allowing you to hold and manage multiple currencies effortlessly.

Experience the convenience and security of EnWallet’s Prepaid Card, designed for seamless transactions and smart budgeting.

Unlock the power of connectivity with EnWallet’s Open Banking feature, giving you full control and transparency over your financial data.

Loyalty and Cashback

QR Payments

Legal and Performance Reports

Bill Payments

Virtual POS and Payment Facilitation

Instant Money Transfers

Account Monitoring

Customer Management

Branch and Agency Management

Currency Exchange

Multi Channel Top Up

Limit Management

Fees and Commission Management

Middleware

EnWallet Middleware lets you design wallet APIs for your partners, enabling you to become a WaaS (Wallet as a Service) provider. Furthermore, with EnWallet Middleware, it is easy and simple to integrate 3rd. party financial services into your platform.

Hakan Saygın

PayPole – Chairman on the Board & General Manager

For our mobile and web applications, we chose EnNovate and EnWallet because they meet all our needs and are user-friendly. With these products, which have emerged by blending professionalism and experience, our customers can carry out their transactions quickly and smoothly. At the same time, with EnSecure soft OTP, we both fully comply with the legislation and enable our customers to carry out their transactions more securely.